Navigating the Shifting Landscape: Understanding FEMA Flood Map Changes in 2021

Related Articles: Navigating the Shifting Landscape: Understanding FEMA Flood Map Changes in 2021

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Shifting Landscape: Understanding FEMA Flood Map Changes in 2021. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Shifting Landscape: Understanding FEMA Flood Map Changes in 2021

The Federal Emergency Management Agency (FEMA) plays a crucial role in mitigating flood risks across the United States. Its Flood Insurance Rate Maps (FIRMs) are essential tools for property owners, lenders, and local governments, providing crucial information on flood risk areas. However, these maps are not static. They are regularly updated to reflect changes in flood risk, driven by factors like climate change, development patterns, and improved data collection.

The year 2021 witnessed significant updates to FEMA FIRMs, impacting numerous communities nationwide. These changes, while essential for accurate flood risk assessment, can also have substantial implications for property owners and communities alike. This article aims to provide a comprehensive understanding of these updates, their potential impact, and the steps individuals and communities can take to adapt.

Understanding the Foundation: What are FEMA Flood Maps?

FEMA FIRMs are detailed maps that delineate areas susceptible to flooding, categorizing them into different flood zones based on their likelihood of experiencing flooding. These zones are crucial for various reasons:

- Flood Insurance Requirements: Properties located in designated flood zones are typically required to purchase flood insurance. This is a critical measure to protect homeowners from financial devastation in the event of a flood.

- Community Planning and Development: Local governments use FIRMs to guide land-use planning, zoning regulations, and infrastructure development, ensuring safer and more resilient communities.

- Mortgage Lending: Lenders rely on FIRMs to assess the flood risk of properties, impacting loan eligibility and interest rates.

The 2021 Updates: A Catalyst for Change

The 2021 updates to FEMA FIRMs were driven by a combination of factors, including:

- Advancements in Flood Modeling: FEMA continuously refines its flood modeling techniques, incorporating more accurate data and improved scientific understanding of flood dynamics.

- Climate Change Impacts: The increasing frequency and intensity of extreme weather events, driven by climate change, necessitate adjustments to flood risk assessments.

- Data Collection Initiatives: New data sources, including high-resolution LiDAR (Light Detection and Ranging) data and improved precipitation records, provide a more detailed understanding of flood hazards.

Key Changes and Their Implications:

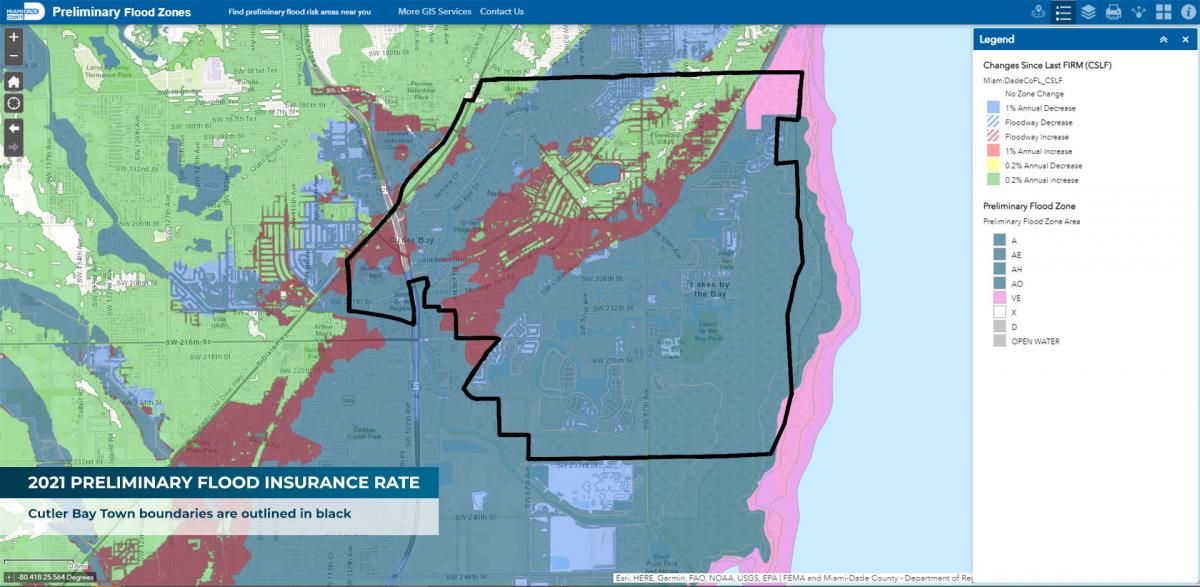

The 2021 updates resulted in significant changes to FEMA FIRMs, impacting both individual property owners and entire communities:

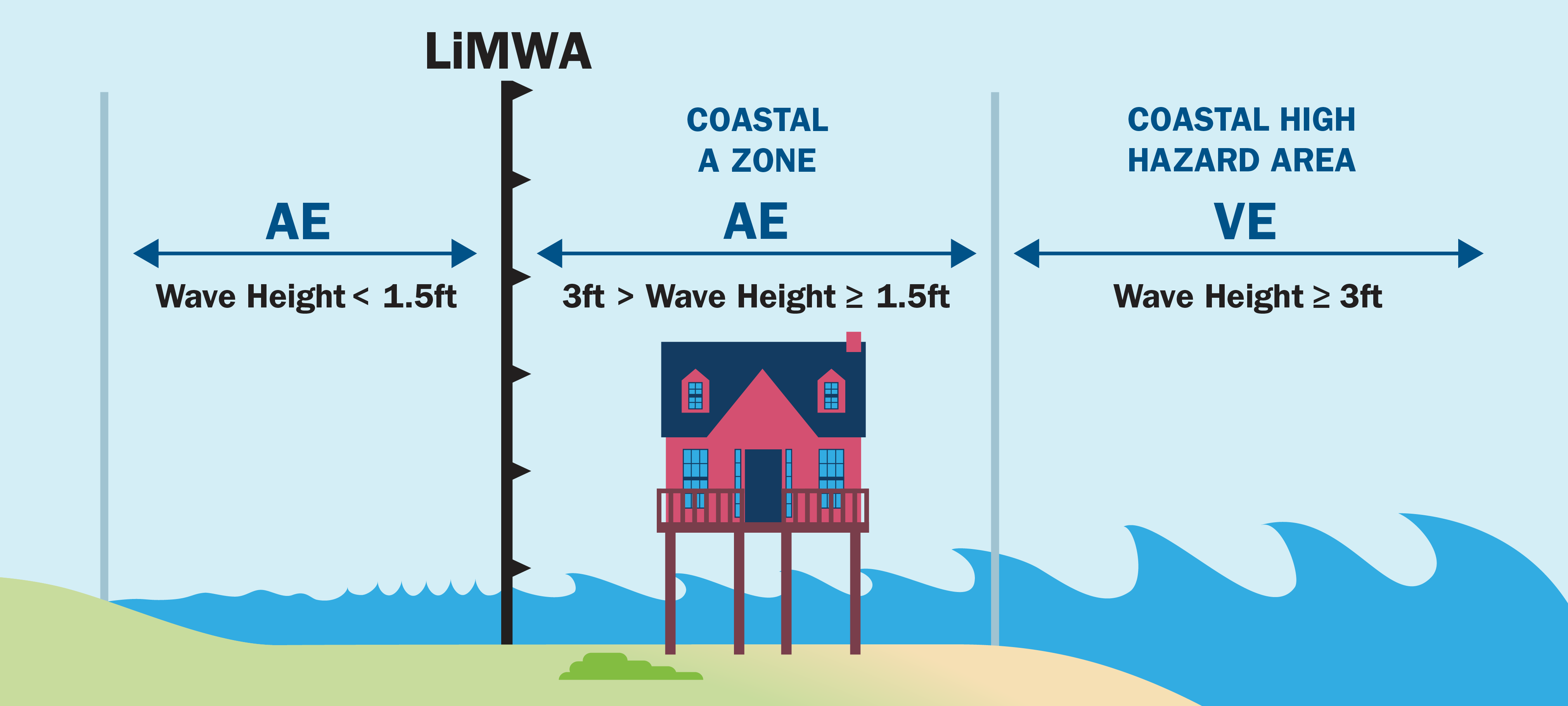

- Zone Reclassifications: Some areas previously considered low-risk may have been reclassified to higher-risk zones, potentially impacting flood insurance requirements and property values.

- New Flood Zones: Previously unmapped areas may have been added to flood zones due to improved data and modeling techniques.

- Changes in Base Flood Elevations (BFEs): The elevation of the base flood, which is the flood level used to determine flood insurance rates, may have been revised, potentially affecting flood insurance premiums.

Navigating the Changes: A Guide for Property Owners

Understanding the implications of these changes is crucial for property owners. Here are some key steps to take:

- Consult the New FIRMs: The first step is to access the updated FIRMs for your area and understand the changes. FEMA provides online tools and resources to facilitate this process.

- Review Flood Insurance Coverage: Property owners should review their flood insurance policies to ensure adequate coverage in light of the new flood zones and BFEs.

- Consider Mitigation Measures: If your property has been reclassified to a higher-risk zone, consider implementing flood mitigation measures, such as elevating structures or installing flood barriers.

- Consult with Experts: If you have questions or concerns, contact a qualified professional, such as a floodplain manager or insurance agent, for guidance.

Community-Level Considerations:

The impact of FEMA FIRMs extends beyond individual property owners. Communities also need to adapt to these changes:

- Updating Local Ordinances: Local governments should review and update their zoning ordinances and building codes to reflect the new flood risk information.

- Investing in Flood Mitigation: Communities can invest in infrastructure projects, such as floodwalls, levees, and drainage improvements, to enhance flood resilience.

- Public Awareness Campaigns: Local governments and community organizations should educate residents about the updated FIRMs and the importance of flood preparedness.

FAQs on FEMA Flood Map Changes

Q: How do I access the updated FEMA FIRMs for my area?

A: FEMA provides various resources for accessing FIRMs, including an interactive online map viewer and downloadable data. You can find these resources on the FEMA website.

Q: What if my property has been reclassified to a higher-risk zone?

A: Reclassification to a higher-risk zone may necessitate purchasing flood insurance or increasing existing coverage. You should contact your insurance provider to discuss your options.

Q: What are the benefits of implementing flood mitigation measures?

A: Flood mitigation measures can reduce damage to your property, lower flood insurance premiums, and improve the safety of your community.

Q: How can I get involved in community-level efforts to address flood risk?

A: You can participate in local planning meetings, join community organizations focused on flood mitigation, and advocate for policies that promote flood resilience.

Tips for Adapting to FEMA Flood Map Changes

- Stay Informed: Regularly check FEMA’s website and local news sources for updates on flood risk and mitigation strategies.

- Participate in Community Events: Attend public meetings and workshops related to flood risk and preparedness.

- Develop a Family Emergency Plan: Prepare a plan that outlines evacuation routes, communication strategies, and essential supplies in case of a flood.

Conclusion: A Call for Action

FEMA flood map changes are a reflection of evolving flood risks and the importance of adapting to a changing environment. By understanding these changes, property owners and communities can take proactive steps to mitigate flood risks, protect their investments, and build a more resilient future. While the updates may present challenges, they also offer an opportunity to enhance flood preparedness and reduce vulnerability to future flood events. Engaging with the new information, taking informed action, and collaborating with local authorities are crucial steps towards achieving greater flood resilience.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Shifting Landscape: Understanding FEMA Flood Map Changes in 2021. We hope you find this article informative and beneficial. See you in our next article!