Navigating the SBA’s Targeted EIDL Advance Program: A Comprehensive Guide

Related Articles: Navigating the SBA’s Targeted EIDL Advance Program: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the SBA’s Targeted EIDL Advance Program: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the SBA’s Targeted EIDL Advance Program: A Comprehensive Guide

The COVID-19 pandemic posed unprecedented challenges for businesses across the United States. Recognizing the urgent need for economic relief, the Small Business Administration (SBA) implemented various programs, including the Economic Injury Disaster Loan (EIDL) Program and its subsequent Targeted EIDL Advance Program. This guide provides a comprehensive overview of the Targeted EIDL Advance Program, outlining its purpose, eligibility criteria, and key features, along with valuable insights for potential applicants.

Understanding the Targeted EIDL Advance Program

The Targeted EIDL Advance Program was a vital component of the SBA’s response to the economic fallout caused by the pandemic. This program provided non-repayable grants to eligible small businesses impacted by COVID-19, serving as a crucial lifeline during a period of significant uncertainty.

Key Features of the Targeted EIDL Advance Program:

- Non-Repayable Grants: Unlike traditional loans, the Targeted EIDL Advance was a grant, meaning recipients were not obligated to repay the funds.

- Targeted Assistance: The program focused on providing aid to businesses that experienced a significant revenue decline due to the pandemic, prioritizing those in underserved communities.

- Limited Availability: The program had a finite pool of funds, and applications were processed on a first-come, first-served basis.

- Simplified Application Process: The SBA streamlined the application process, making it relatively straightforward for eligible businesses to access the assistance.

Eligibility Criteria for the Targeted EIDL Advance Program:

- Small Business Status: Applicants had to meet the SBA’s definition of a small business, which varies depending on industry and location.

- Economic Impact from COVID-19: Businesses were required to demonstrate a significant revenue decline due to the pandemic, typically exceeding 30%.

- Location in a Targeted Area: The program prioritized businesses located in areas designated as economically disadvantaged or experiencing high rates of COVID-19 cases.

- Previous EIDL Loan Application: Applicants needed to have already applied for an EIDL loan, even if their application was denied or they received a smaller loan amount.

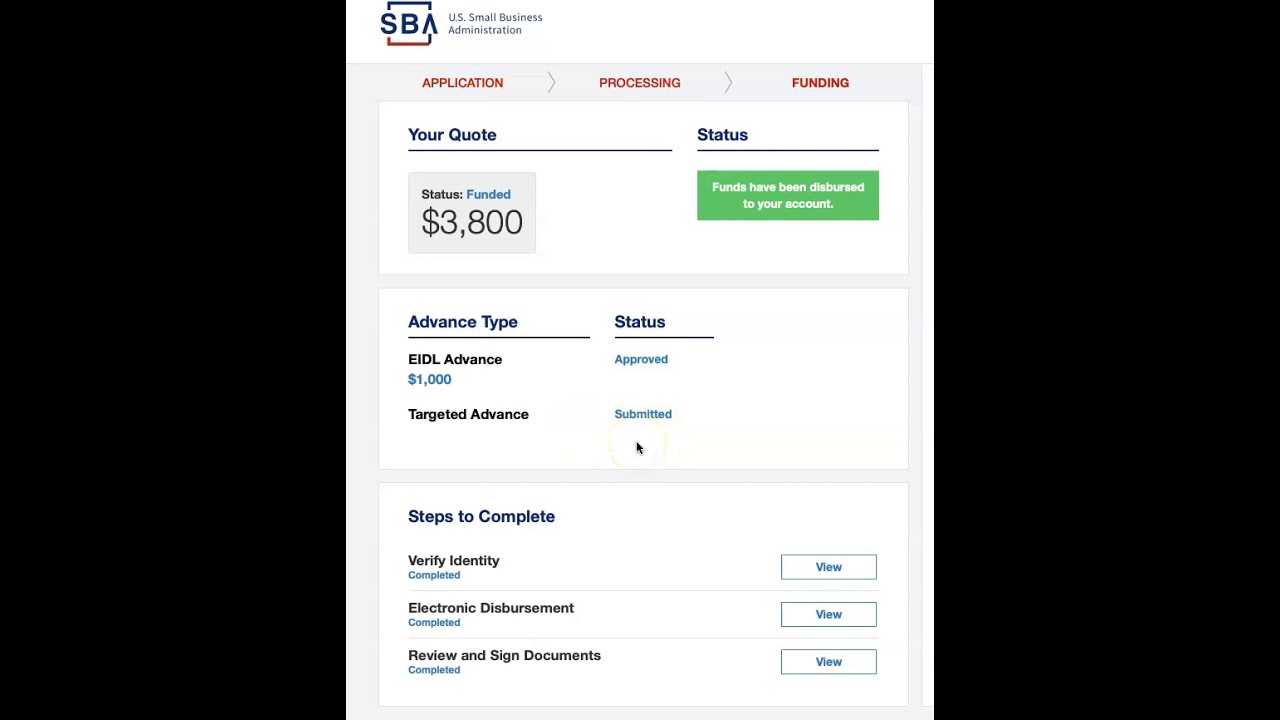

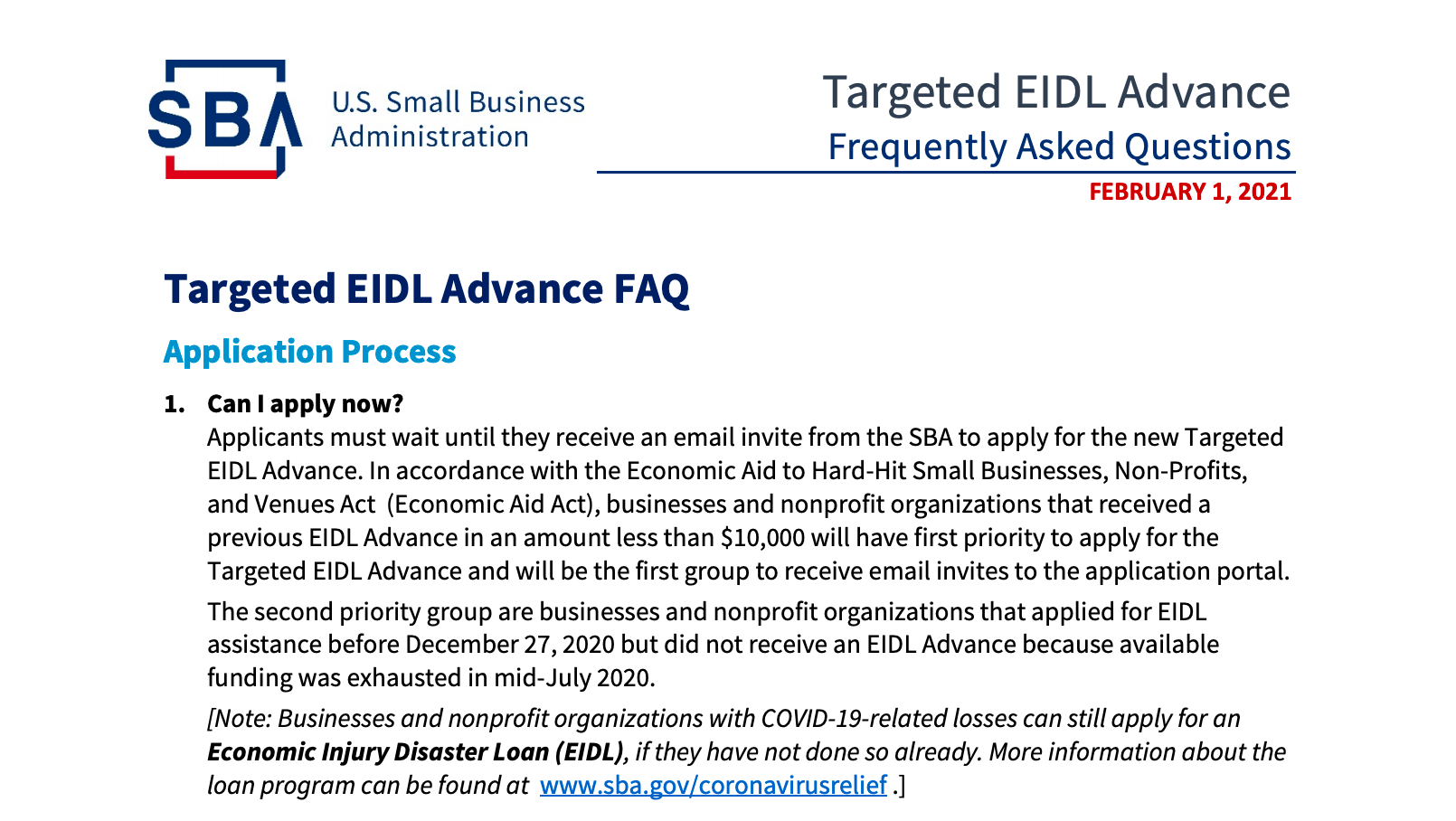

Navigating the Application Process:

- Eligibility Verification: The first step involved confirming eligibility by meeting the aforementioned criteria.

- Application Submission: Once deemed eligible, businesses could submit their applications through the SBA’s online portal.

- Review and Approval: The SBA reviewed applications and processed them on a first-come, first-served basis.

- Grant Disbursement: Approved applicants received the Targeted EIDL Advance directly deposited into their bank accounts.

Benefits of the Targeted EIDL Advance Program:

- Immediate Financial Relief: The non-repayable grants provided immediate financial assistance, allowing businesses to cover essential expenses and maintain operations during a difficult period.

- Business Sustainability: The funds helped businesses bridge revenue gaps, preventing potential closures and safeguarding jobs.

- Economic Recovery: By supporting small businesses, the program contributed to the overall economic recovery process.

FAQs Regarding the Targeted EIDL Advance Program:

1. How much was the Targeted EIDL Advance?

The Targeted EIDL Advance amount was determined based on the number of employees at the time of application. Businesses with 10 or fewer employees received a maximum of $1,000, while businesses with 500 or more employees received a maximum of $10,000.

2. Is the Targeted EIDL Advance still available?

The Targeted EIDL Advance Program has been closed to new applications. The program ended on December 31, 2021, with all available funds allocated.

3. What if my Targeted EIDL Advance application was denied?

If your application was denied, you may have been ineligible based on the program’s specific criteria. It is recommended to review the eligibility requirements carefully and consider alternative funding options.

4. What if I received a smaller Targeted EIDL Advance than I expected?

The program had limited funding, and the amount received was based on the number of employees and the availability of funds. If you received a smaller amount than anticipated, you may want to explore other financial assistance programs.

5. Do I need to repay the Targeted EIDL Advance?

No, the Targeted EIDL Advance was a non-repayable grant. You are not obligated to repay the funds.

Tips for Potential Applicants:

- Early Application: The program was highly competitive, with limited funds. Submitting your application promptly increased your chances of receiving the grant.

- Accurate Information: Ensure that all information provided in your application is accurate and complete.

- Documentation: Gather all necessary documentation, including business records, tax returns, and payroll information, to support your application.

- Contact the SBA: If you have questions or require assistance, contact the SBA directly through their website or helpline.

Conclusion:

The Targeted EIDL Advance Program played a crucial role in providing financial assistance to small businesses impacted by the COVID-19 pandemic. While the program is now closed, its legacy remains as a testament to the SBA’s commitment to supporting entrepreneurs during times of crisis. By understanding the program’s key features, eligibility criteria, and benefits, businesses can gain valuable insights into navigating future economic challenges and exploring alternative funding options.

Closure

Thus, we hope this article has provided valuable insights into Navigating the SBA’s Targeted EIDL Advance Program: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!