Navigating the Field of Financial Inclusion: A Comprehensive Look at MoneyGram’s Global Network

Related Articles: Navigating the Field of Financial Inclusion: A Comprehensive Look at MoneyGram’s Global Network

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Field of Financial Inclusion: A Comprehensive Look at MoneyGram’s Global Network. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Field of Financial Inclusion: A Comprehensive Look at MoneyGram’s Global Network

In the contemporary landscape of international finance, the seamless transfer of funds across borders is paramount. MoneyGram, a leading global provider of money transfer services, facilitates this process with a vast network that reaches over 200 countries and territories. This article delves into the intricacies of MoneyGram’s network, exploring its structure, functionalities, and the pivotal role it plays in fostering financial inclusion.

Understanding the MoneyGram Network: A Global Reach

MoneyGram’s network is a complex tapestry woven from various interconnected components, each playing a crucial role in enabling cross-border transfers.

1. Agents and Locations: The backbone of MoneyGram’s network comprises its extensive agent network, comprising banks, financial institutions, retailers, and other businesses. These agents serve as physical touchpoints where customers can send and receive money.

2. Digital Channels: Recognizing the increasing demand for digital solutions, MoneyGram has integrated digital platforms into its network. Customers can now send and receive money online, via mobile apps, or through dedicated mobile wallets.

3. Payment Systems: MoneyGram leverages various payment systems to facilitate transfers, including bank accounts, credit cards, debit cards, and cash pick-up. This diversity ensures flexibility and convenience for customers.

4. Technology Infrastructure: At the heart of MoneyGram’s network lies a robust technology infrastructure that enables secure, fast, and efficient transactions. This infrastructure includes proprietary software, secure data centers, and advanced security measures.

The Importance of MoneyGram’s Network: Bridging the Gap

MoneyGram’s global reach and diverse network play a vital role in promoting financial inclusion, empowering individuals and communities worldwide.

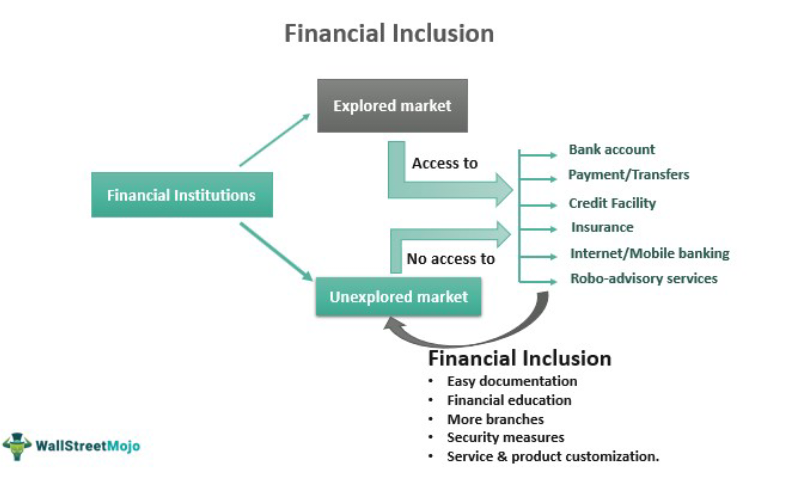

1. Connecting the Unbanked: A significant portion of the global population lacks access to traditional banking services. MoneyGram’s network, with its extensive agent network and digital channels, provides a lifeline for these individuals, enabling them to send and receive money conveniently and securely.

2. Facilitating Remittances: MoneyGram is a critical player in the global remittance industry, facilitating the transfer of funds from migrant workers to their families back home. This service plays a crucial role in supporting families and communities in developing countries.

3. Supporting Businesses: MoneyGram’s network enables businesses to operate seamlessly across borders, facilitating international payments, supplier payments, and payroll services. This fosters economic growth and global trade.

4. Expanding Financial Access: MoneyGram’s network contributes to expanding financial access, particularly in underserved communities. By providing convenient and affordable services, MoneyGram empowers individuals to participate in the global economy.

Navigating the Network: A User’s Perspective

Understanding how MoneyGram’s network functions is essential for individuals and businesses seeking to utilize its services. Here’s a step-by-step guide to sending and receiving money through MoneyGram:

1. Sending Money:

- Choose a Sending Method: Select your preferred sending method, either online, via mobile app, or through a physical agent location.

- Provide Recipient Information: Enter the recipient’s name, country, and preferred receiving method.

- Select Payment Method: Choose your payment method, such as bank account, credit card, debit card, or cash.

- Confirm and Send: Review the transaction details and confirm the transfer.

2. Receiving Money:

- Receive Funds: You can receive funds through a MoneyGram agent location, bank account, mobile wallet, or other designated receiving methods.

- Provide Identification: Present a valid form of identification at the receiving location.

- Collect Funds: Receive your funds after verifying your identity and providing the necessary transaction details.

FAQs about MoneyGram’s Network

1. What is the cost of sending money through MoneyGram?

The cost of sending money through MoneyGram varies depending on factors such as the sending and receiving countries, the amount being sent, and the chosen payment method. You can find estimated fees on MoneyGram’s website or by contacting a local agent.

2. How long does it take for money to be transferred through MoneyGram?

The transfer time for MoneyGram transactions typically ranges from minutes to a few days, depending on factors such as the sending and receiving countries, the chosen payment method, and the time of day.

3. Is it safe to send money through MoneyGram?

MoneyGram prioritizes security and employs advanced security measures to protect customer transactions. However, it’s crucial to exercise caution and follow best practices for online and financial transactions.

4. How can I track my MoneyGram transaction?

You can track your MoneyGram transaction online or via the MoneyGram mobile app using the provided tracking number.

5. What are the currency options available for MoneyGram transfers?

MoneyGram supports a wide range of currencies, allowing customers to send and receive money in their preferred currency.

Tips for Utilizing MoneyGram’s Network

- Compare Fees: Before sending money, compare fees across different money transfer providers to ensure you’re getting the best value.

- Use Trusted Agents: When sending or receiving money through a physical agent location, ensure the agent is reputable and authorized by MoneyGram.

- Protect Your Information: Never share your personal or financial information with unauthorized individuals or websites.

- Utilize Digital Channels: Consider using MoneyGram’s digital platforms for faster and more convenient transactions.

- Track Your Transactions: Monitor your transaction status regularly to ensure a smooth transfer process.

Conclusion

MoneyGram’s global network stands as a testament to the company’s commitment to fostering financial inclusion. By providing secure, convenient, and affordable money transfer services, MoneyGram empowers individuals and businesses to connect and transact seamlessly across borders. As the world becomes increasingly interconnected, MoneyGram’s network will continue to play a pivotal role in facilitating economic growth, promoting financial inclusion, and bridging the gap between communities.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Field of Financial Inclusion: A Comprehensive Look at MoneyGram’s Global Network. We thank you for taking the time to read this article. See you in our next article!